The Consumer Price Index (CPI) inflation report is one of the most closely watched economic indicators in the world. It tells us how much prices are rising or falling for everyday goods and services that households buy. This single report can influence government policies, central bank interest rate decisions, business strategies, and even the stock market’s next move. For investors, businesses, and ordinary consumers, understanding the CPI inflation report is essential to making informed decisions about spending, saving, and investing. In this comprehensive guide, we will break down everything you need to know about the CPI inflation report — from its definition and methodology to its impact on the economy and financial markets. The CPI inflation report measures the average change in prices paid by consumers for a basket of goods and services over a specific period, usually monthly or annually. In simple terms, it is a measure of how expensive life is getting for the average consumer. The "basket" of goods and services typically includes: Food and beverages Housing (rent, utilities) Apparel Transportation (including gasoline and public transit) Medical care Education Recreation Other goods and services The report compares the cost of this basket to previous periods, which helps economists, policymakers, and businesses understand price trends. The CPI is calculated by collecting price data from thousands of retail stores, service providers, rental units, and other outlets. These prices are then averaged and weighted according to their importance in a typical household’s budget. For example, housing tends to have a larger weight than entertainment because people spend a bigger share of their income on rent or mortgages. Once the prices are collected, they are compared with a base year index. The change between the two gives us the rate of inflation. For instance: If CPI last year was 250 and this year it is 260, inflation is 4 percent. A CPI increase means prices are going up (inflation). A CPI decrease means prices are going down (deflation). The CPI inflation report has a significant impact on multiple areas of the economy: Central banks like the U.S. Federal Reserve, the European Central Bank, and the Reserve Bank of India use CPI data to decide whether to raise or cut interest rates. If inflation is too high, they may raise interest rates to cool down spending. If inflation is too low, they may lower interest rates to encourage spending. Governments use CPI data to adjust wages, pensions, and tax brackets to keep up with the cost of living. This ensures that public benefits maintain their real purchasing power. Businesses monitor CPI trends to adjust pricing, negotiate supply contracts, and forecast future costs. If inflation is rising, companies may increase prices to protect profit margins. Investors watch the CPI report because it can affect stock, bond, and commodity markets. High inflation can hurt bonds as interest rates rise. Some stocks may benefit from inflation if companies can pass on costs to consumers. Commodities like gold often rise when inflation is high because investors see them as a safe haven. Consumers adjust their spending habits based on rising or falling prices. For example, if food inflation is high, households may switch to cheaper alternatives or reduce discretionary spending. CPI is often reported in two ways: Headline CPI: Includes all items in the basket, including volatile categories like food and energy. This gives the overall picture of inflation. Core CPI: Excludes food and energy prices, which can fluctuate widely due to weather, geopolitical issues, or supply chain disruptions. Core CPI helps policymakers see the underlying trend in inflation. For example, if gasoline prices spike temporarily, headline CPI might jump, but core CPI may remain stable — signaling that overall inflationary pressures are not as severe. Inflation, as measured by CPI, affects every aspect of the economy: Moderate inflation is considered healthy for economic growth. It encourages spending and investment because people expect prices to rise in the future. However, very high inflation can reduce purchasing power and slow economic activity. Inflation and employment are connected through the Phillips Curve, which suggests that low unemployment can lead to higher inflation because demand for goods and services rises. If inflation is rising faster than wages, consumers experience a decline in real income. This can lead to demands for higher wages, which can create a wage-price spiral if not controlled. Traders and investors often react strongly to CPI data because it can signal future interest rate changes. Stocks: Growth stocks can be hurt by high inflation because their future cash flows become less valuable when interest rates rise. Bonds: Inflation erodes the value of fixed income payments, so bond prices tend to fall when inflation rises. Commodities: Oil, gold, and other commodities often rally during inflationary periods because they are seen as a hedge against currency depreciation. While CPI is the most common measure of inflation, it is not the only one. Some other measures include: Wholesale Price Index (WPI): Measures prices at the wholesale level. Producer Price Index (PPI): Tracks price changes from the perspective of producers. Personal Consumption Expenditures (PCE) Price Index: Another inflation measure favored by the U.S. Federal Reserve because it covers a broader range of expenditures. Each index serves a different purpose, but CPI remains the most familiar for the general public. While CPI is a valuable tool, it is not without its limitations: Substitution Bias: Consumers may switch to cheaper alternatives when prices rise, but CPI might not fully capture this behavior. Quality Adjustments: CPI tries to adjust for improvements in product quality, but this process can be complex and imperfect. Urban Focus: CPI is often based on urban spending patterns, which may not reflect rural consumers accurately. Despite these challenges, CPI remains the benchmark for measuring inflation worldwide. A CPI report usually contains: Month-over-month change in CPI Year-over-year change in CPI Core CPI figures Key categories that contributed most to the change (e.g., energy, food, housing) When analyzing the report, look beyond the headline number. Check which sectors are driving inflation. For example, if inflation is rising due to temporary spikes in fuel prices, it may not be a long-term concern. For households, understanding CPI can help in financial planning: Adjust your budget for rising living costs. Consider inflation-protected investments like Treasury Inflation-Protected Securities (TIPS). Negotiate salary hikes or review your expenses if inflation is eating into purchasing power. CPI inflation reports are released by most countries, but the frequency and methodology may vary. Comparing inflation across countries helps businesses plan international operations and investors assess currency risks. CPI inflation report measures price changes for a basket of goods and services. It is crucial for economic policy, business planning, and financial market decisions. Core CPI strips out volatile items for a clearer long-term trend. Investors and consumers can use CPI data to make smarter financial decisions. Q1: How often is the CPI inflation report released? Q2: What is considered a healthy level of CPI inflation? Q3: Why do markets react strongly to CPI data? Q4: How does CPI affect my salary or income? Q5: Is CPI the same in every country? Q6: Can CPI ever be negative?What Is the CPI Inflation Report?

How the CPI Is Calculated

Why the CPI Inflation Report Matters

1. Central Bank Policy

2. Government Planning

3. Business Decisions

4. Investment Strategies

5. Consumer Behavior

Headline CPI vs. Core CPI

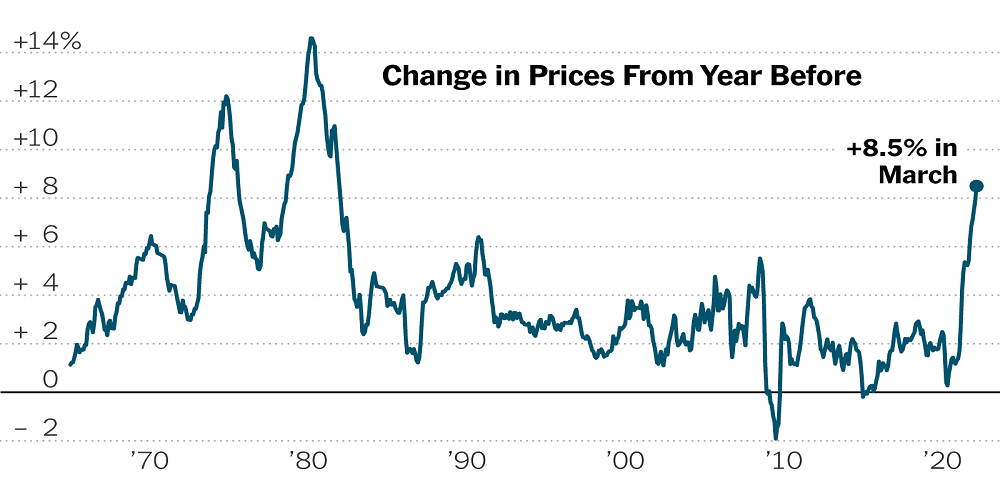

CPI and the Economy

Economic Growth

Employment

Wages

CPI Report and Financial Markets

CPI vs. Other Inflation Measures

Challenges and Criticisms of CPI

How to Read and Interpret a CPI Report

CPI Inflation and Your Personal Finances

Global Perspective

Key Takeaways

FAQs

Most countries release CPI data monthly, though some may also provide quarterly or annual summaries.

Central banks usually target around 2 percent annual inflation, which is considered healthy for economic growth.

Because CPI influences central bank decisions on interest rates, which directly affect borrowing costs, stock prices, and bond yields.

If inflation rises, your real purchasing power decreases unless your salary increases proportionally. Some employers use CPI data to adjust wages annually.

No, the CPI basket and methodology can differ depending on consumer habits and government agencies, but the basic principle is the same worldwide.

Yes, when prices fall overall, CPI can be negative. This is known as deflation.

It is generally reliable but may not fully capture changes in consumer behavior, quality improvements, or regional price differences.

Leave A Comment

0 Comment