Meta stock has become one of the most talked-about technology investments of the past decade. As the parent company of Facebook, Instagram, WhatsApp, and Reality Labs, Meta Platforms Inc. plays a major role in shaping the digital world. Because of its influence in social media, advertising, artificial intelligence, and virtual reality, meta stock attracts attention from both beginner and experienced investors.

In this in-depth guide, we will explore what meta stock represents, how the company earns money, its growth drivers, risks, financial performance trends, and whether meta stock may deserve a place in a long-term investment portfolio.

What Is Meta Stock?

Meta stock refers to shares of Meta Platforms Inc., the technology company formerly known as Facebook. The company rebranded to Meta in 2021 to reflect its focus on building the “metaverse,” a digital environment combining virtual reality, augmented reality, and social interaction.

When investors buy meta stock, they are purchasing partial ownership in a business that operates some of the world’s most widely used digital platforms. These include:

- Messenger

- Reality Labs products like Quest VR headsets

Because of this diverse portfolio, meta stock is often viewed as both a social media investment and a future technology play.

The Business Model Behind Meta Stock

Understanding the business model is key to evaluating meta stock. Meta generates the majority of its revenue from digital advertising. Businesses pay to display ads across Facebook, Instagram, and other platforms. With billions of active users, Meta offers advertisers powerful targeting tools based on user behavior and interests.

Advertising Revenue

Advertising remains the foundation of meta stock performance. Small businesses, global brands, and online sellers rely heavily on Meta platforms to reach customers. This steady demand for ad space has historically supported strong revenue growth.

Family of Apps

Meta’s “Family of Apps” segment includes Facebook, Instagram, Messenger, and WhatsApp. This segment drives most of the company’s profit. Investors watching meta stock closely track user growth, engagement levels, and ad pricing trends in these apps.

Reality Labs and the Metaverse

Reality Labs is Meta’s long-term bet on virtual and augmented reality. While this segment currently operates at a loss, it represents a potential future growth engine. Investors interested in innovation often see this division as a reason to hold meta stock for the long term.

Why Meta Stock Is Popular Among Investors

Meta stock appeals to investors for several reasons. It combines strong cash flow from advertising with high-risk, high-reward investments in new technology.

Massive Global User Base

Meta platforms reach billions of users worldwide. This scale makes meta stock attractive because it provides advertisers unmatched reach.

Strong Cash Flow

Even while investing heavily in research and development, Meta generates significant free cash flow. This financial strength allows the company to fund innovation, buy back shares, and improve its balance sheet — all positive signals for meta stock holders.

Leadership in Digital Advertising

Meta is one of the largest digital advertising companies in the world. Its ability to use artificial intelligence for ad targeting helps maintain competitive advantages. This leadership position supports long-term confidence in meta stock.

Key Growth Drivers for Meta Stock

Several factors could influence the future performance of meta stock. Investors often watch these growth drivers when deciding whether to buy or hold.

Expansion of Short-Form Video

Instagram Reels and Facebook video content compete with platforms like TikTok. Monetizing short-form video is crucial for sustaining ad revenue growth and supporting meta stock value.

Artificial Intelligence Integration

Meta uses AI to improve ad targeting, content recommendations, and user engagement. AI-driven efficiency could boost profitability, which may positively impact meta stock over time.

Growth in Emerging Markets

As internet access expands globally, Meta continues to gain users in developing countries. This growth can create new advertising opportunities and strengthen meta stock performance.

Metaverse Development

Though still early, Meta’s investments in virtual reality could create entirely new revenue streams. If the metaverse vision succeeds, meta stock could benefit from being an early leader in this space.

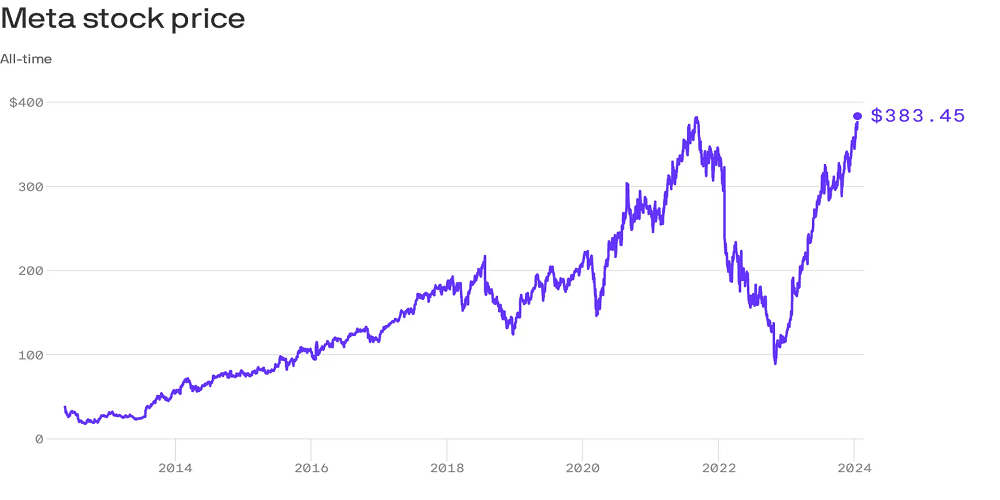

Financial Performance and Meta Stock Trends

When analyzing meta stock, investors often review revenue growth, profit margins, and operating expenses.

Revenue Growth

Meta has historically reported strong year-over-year revenue increases driven by advertising demand. Even during economic slowdowns, digital advertising often remains resilient, which supports the stability of meta stock.

Profit Margins

Meta’s core apps have high operating margins. However, heavy spending on Reality Labs reduces overall profitability. Investors who follow meta stock understand this trade-off between short-term profit and long-term innovation.

Share Buybacks

Meta has used share repurchase programs to return value to shareholders. Buybacks can increase earnings per share, which may support the price of meta stock.

Risks to Consider Before Buying Meta Stock

While meta stock offers growth potential, it also carries risks. Understanding these challenges is important for balanced decision-making.

Regulatory Pressure

Governments worldwide are increasing scrutiny of large technology companies. Privacy rules, antitrust investigations, and advertising restrictions could impact revenue and affect meta stock performance.

Competition

Meta competes with TikTok, YouTube, Snapchat, and other platforms for user attention and ad spending. If engagement shifts away from Meta apps, meta stock could face pressure.

Metaverse Uncertainty

The metaverse remains an unproven concept. Heavy investment without clear returns could weigh on profits, creating volatility for meta stock investors.

Advertising Market Cycles

Economic downturns can reduce ad budgets. Because advertising is Meta’s main revenue source, slowdowns may impact meta stock earnings.

Meta Stock and Long-Term Investing

Many investors view meta stock as a long-term growth opportunity. The company’s ability to adapt to changing trends has been demonstrated multiple times, from desktop to mobile and now to video and AI.

Long-term investors often focus less on short-term price swings and more on user growth, innovation, and advertising strength. If Meta continues evolving successfully, meta stock could remain a key player in technology portfolios.

Comparing Meta Stock to Other Tech Stocks

Meta stock is often compared with other large technology companies. Unlike hardware-focused firms, Meta relies on digital platforms and advertising. Compared to subscription-based companies, Meta offers free services funded by ads.

This difference makes meta stock more sensitive to advertising trends but also allows rapid scaling with relatively low distribution costs. Investors seeking exposure to social media and digital ads often choose meta stock for this reason.

Dividends and Shareholder Returns

Meta has historically reinvested profits into growth rather than paying large dividends. Instead, shareholder returns have mainly come from stock price appreciation and buybacks.

Investors considering meta stock typically prioritize capital growth over income. However, strong cash flow gives the company flexibility to adjust its return strategy in the future.

How Analysts Evaluate Meta Stock

Professional analysts often examine:

- User engagement metrics

- Advertising growth rates

- Cost control and operating efficiency

- Progress in AI and virtual reality

These factors influence price targets and investor sentiment toward meta stock.

Is Meta Stock Suitable for Beginners?

Meta stock can be suitable for beginners who want exposure to large technology companies. However, like all stocks, it comes with volatility. New investors should consider diversification and avoid putting all their money into a single stock, even one as large as Meta.

Future Outlook for Meta Stock

The future of meta stock depends on balancing its mature advertising business with emerging technologies. Continued innovation in AI, improved ad performance, and careful spending on the metaverse could strengthen long-term results.

If Meta succeeds in turning its virtual reality investments into profitable ecosystems, meta stock may gain a new growth narrative beyond social media. On the other hand, if these investments fail, the company will need to rely more heavily on advertising to drive returns.

Final Thoughts on Meta Stock

Meta stock represents a mix of stability and innovation. Its massive user base and advertising engine provide financial strength, while investments in AI and virtual reality offer future potential. For investors willing to accept some uncertainty in exchange for growth opportunities, meta stock remains one of the most closely watched technology shares in the market.

As always, investment decisions should align with personal financial goals, risk tolerance, and time horizon.

FAQs About Meta Stock

1. What does meta stock represent?

Meta stock represents ownership in Meta Platforms Inc., the company behind Facebook, Instagram, WhatsApp, and its metaverse initiatives.

2. How does meta stock make money for investors?

Meta stock generates value primarily through advertising revenue, business growth, and potential stock price appreciation over time.

3. Is meta stock a good long-term investment?

Meta stock may be suitable for long-term investors who believe in digital advertising growth and future technologies like AI and virtual reality.

4. Does meta stock pay dividends?

Meta stock has focused more on reinvesting profits and share buybacks rather than offering large dividends.

5. What are the biggest risks for meta stock?

Major risks include regulation, competition, economic downturns affecting ad spending, and uncertainty around metaverse investments.

6. Why is meta stock considered a tech growth stock?

Meta stock is linked to innovation in social media, artificial intelligence, and virtual reality, which are high-growth technology areas.

7. Can beginners invest in meta stock?

Yes, beginners can invest in meta stock, but they should diversify and understand market risks before investing.

8. How does advertising affect meta stock performance?

Since advertising is the core revenue source, strong ad demand generally supports meta stock, while weak ad markets can create pressure.

9. What makes meta stock different from other social media companies?

Meta stock is backed by multiple major platforms and significant investments in future technologies, giving it broader diversification than many competitors.

10. Is meta stock connected to the metaverse?

Yes, meta stock reflects Meta’s investments in building virtual and augmented reality technologies aimed at developing the metaverse.

Leave A Comment

0 Comment