Jensen Huang is one of the most significant figures in modern technology — the Taiwanese-American co-founder, president and CEO of NVIDIA Corporation (NVDA). Under his leadership, NVIDIA evolved from a graphics-chip company into a global powerhouse of computing, artificial intelligence (AI) and data-centre infrastructure. His personal wealth has soared in tandem with the company’s rise, making his net worth a frequent topic of discussion among financial, tech and business media.

This article takes an in-depth look at Jensen Huang’s net worth: how it’s calculated, what drives it, how it has changed over time, and what it might mean for the future. We will also explore aspects of his ownership, compensation, philanthropic efforts, and some frequently asked questions about his wealth.

Current Estimated Net Worth

Estimating Jensen Huang’s net worth is complicated by the fact that the majority of his wealth is tied up in stock of NVIDIA, whose value fluctuates significantly. Here is a summary of publicly reported estimates:

- According to the Bloomberg Billionaires Index, Huang’s net worth stands at about US$154 billion (date unspecified). (Bloomberg)

- A report by Benzinga in August 2025 estimates his wealth at US$158.1 billion, noting he owns approximately 3.7% of NVIDIA. (Benzinga)

- Other sources from mid-2025 note figures such as around US$140 billion after NVIDIA achieved a US$4 trillion market cap. (24/7 Wall St.)

- Earlier in 2025, some reports cited a net worth of US$118.3 billion (May 2025) after a major deal for NVIDIA. (The Times of India)

From these, a fair estimate is that his net worth in 2025 is somewhere in the ballpark of US$150 billion to US$160 billion, placing him among the world’s richest individuals.

How His Wealth Is Constructed

Understanding why Jensen Huang is worth that much involves looking at several components:

1. Ownership in NVIDIA

- Huang co-founded NVIDIA in 1993 and remains the largest individual shareholder. (Investopedia)

- Reports indicate he owns roughly 3.5 % to 4 % of NVIDIA’s outstanding shares as of 2025. (fortune.com)

- Because NVIDIA’s market value has surged — reaching a multi-trillion-dollar valuation — even a small percentage yields enormous wealth. (Benzinga)

2. Compensation and Stock Awards

- Beyond his equity stake, Huang receives a formal compensation package as CEO: base salary, stock or restricted shares, bonuses. (Business Insider)

- For instance, in 2024 his total compensation was reported at US$34.2 million. (Benzinga)

- But compared with his equity wealth, this component is modest.

3. Other Assets and Investments

- While his primary asset is NVIDIA equity, Huang has other assets: real estate (e.g., in California, Hawaii) and philanthropic trusts. (Business Insider)

- Given the scale of his NVIDIA holdings, these other assets represent a very small portion of his net worth.

4. Stock Sales & Dilution

- Over time, NVIDIA has issued stock or options (for employees, etc.), which dilutes founder/insider ownership. For instance, a Business Insider piece says Huang’s stake declined from ~12.8 % pre-IPO to ~3.5 %. (Business Insider)

- Also, Huang has sold shares via predetermined trading plans (e.g., rule 10b5-1) to diversify or monetize some holdings. (The Times of India)

The Rise of NVIDIA and Its Impact on Wealth

To understand why Huang’s net worth has grown so dramatically, you have to look at NVIDIA’s evolution:

- Founded in 1993, NVIDIA initially specialised in graphics processing units (GPUs) for gaming and visual computing. (Wikipedia)

- Over the 2010s and into the 2020s, NVIDIA pivoted strongly into AI, data-centres, autonomous vehicles and high-performance computing. This turned its GPUs from gaming components into critical infrastructure for AI. (Investopedia)

- In 2025, NVIDIA achieved a milestone: a market capitalisation of over US$4 trillion — making it one of the most valuable companies in the world. (fortune.com)

- As the company’s value soared, so did Huang’s wealth (via his equity stake) — he reportedly added tens of billions in 2025 alone. (The Economic Times)

Thus, Huang’s wealth is tightly correlated with NVIDIA’s performance and the broader AI boom.

Ownership, Stake & Structure

Here are some additional details on his ownership and governance:

- According to GuruFocus (October 2025), Huang owns approximately 852 million shares of NVIDIA, valuing his stake at around US$158.7 billion. (GuruFocus)

- In SEC proxy statements he holds shares directly and via family trusts/affiliated entities. (Investopedia)

- As CEO and president of NVIDIA, he remains actively involved in strategy, product direction and corporate leadership. This alignment strengthens the link between company performance and his wealth.

How the Net Worth Will Change Going Forward

Given the heavy linkage to NVIDIA stock, a few key drivers will influence Huang’s net worth going forward:

- NVIDIA stock performance: Any up-or down-turn in NVDA will affect his wealth substantially. If the company grows AI revenue, penetrates new markets (e.g., automotive, robotics, edge computing), value may rise. Conversely, downturns or regulatory setbacks could hurt.

- Ownership dilution: If NVIDIA issues more shares (for employees, acquisitions, etc.), founder/insider stakes get diluted, reducing proportional ownership and hence wealth.

- Stock sales/personal diversification: Huang may sell portions of his holdings under trading plans; monetising some of the stake may reduce future upside but lock in gains.

- Regulatory and geopolitical risks: NVIDIA faces export-control issues (e.g., U.S.–China tech tensions), supply chain risks, competition (e.g., AMD, Intel), all of which could affect the business and valuation.

- Philanthropy and taxes: Large gifts or philanthropic commitments can reduce net worth (though many use tax-efficient vehicles).

- New business ventures or investments: If Huang invests in non-NVIDIA properties or ventures, these could diversify his wealth base (either adding new growth or adding risk).

Comparison with Peers

- Although his wealth is enormous, Huang is not quite at the very top of the global wealth rankings — he trails some figures like Elon Musk and Jeff Bezos based on recent estimates. (Business Insider)

- Compared with some founders who retain higher percentages of their companies (e.g., luxury-goods founders), Huang’s equity stake has been diluted more heavily, which limits his relative wealth despite NVIDIA’s tremendous size. (Business Insider)

Philanthropy & Personal Style

Beyond purely financial metrics, Jensen Huang engages in philanthropy and is known for a personal style that contrasts somewhat with ultra-rich flashiness:

- Huang and his wife, Lori Huang, established a foundation (the Jen-Hsun and Lori Huang Foundation). They have donated tens of millions of dollars to institutions such as Oregon State University and Stanford University. (Business Insider)

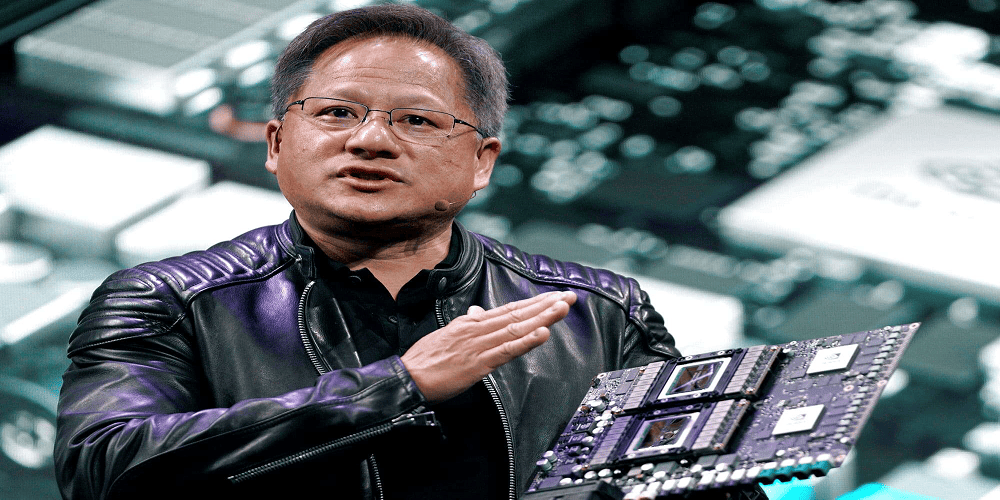

- He is noted for a “signature leather jacket” look — less ostentatious than some billionaires’ wardrobes. (Business Insider)

- While his net worth is large, his public lifestyle appears relatively restrained compared with other billionaire peers.

Key Takeaways

- Jensen Huang’s wealth is largely built on NVIDIA’s exceptional performance and his equity stake in the company.

- Because his wealth is so concentrated in one stock, his net worth is more volatile (up and down) than someone with more diversified holdings.

- The AI boom and NVIDIA’s dominant position in that ecosystem have been the primary drivers of his wealth acceleration in recent years.

- Despite being among the world’s richest people, certain structural factors (like dilution of his stake) mean he doesn’t top the richest-ever lists.

- For those interested in billionaire wealth, Hansen’s story is a reminder that rapid wealth accumulation often tracks innovative enterprise and the rise of platform-tech businesses.

Frequently Asked Questions (FAQs)

Q1: What exactly is Jensen Huang’s net worth right now?

A: Because his wealth is heavily tied to NVIDIA stock, the number changes regularly. As of mid-2025, estimates from multiple sources place it between roughly US$150 billion and US$160 billion. (Benzinga)

Q2: How much of NVIDIA does Jensen Huang own?

A: Public filings and analyses suggest his ownership is about 3.5 % to 4 % of NVIDIA’s outstanding shares. (fortune.com)

Q3: What are the main sources of his wealth?

A: The main source is his large equity stake in NVIDIA. Supplementary sources include annual compensation (salary + stock awards), personal investments and real-estate holdings. But the huge majority comes from NVIDIA equity. (Benzinga)

Q4: Has he sold any NVIDIA shares recently?

A: Yes. For example, in 2025 there were reports of him selling shares under a 10b5-1 trading plan — e.g., selling ~225,000 shares (~US$36.4 million) in July 2025. (The Times of India)

Q5: How did NVIDIA’s valuation impact his wealth?

A: Dramatically. When NVIDIA’s market cap climbed past US$4 trillion in 2025, Huang’s wealth surged — estimates show tens of billions added to his net worth in that year alone. (The Economic Times)

Q6: Why doesn’t he have more wealth, given the size of NVIDIA?

A: Several reasons: over time NVIDIA issued additional shares (dilution) reducing his ownership percentage; he has sold some shares. Also, other billionaires often retain higher percentage ownership of their companies, so even a smaller company can give a higher net worth proportion-wise. (Business Insider)

Q7: Does he have wealth outside of NVIDIA stock?

A: Yes — he has other assets such as real estate and philanthropic commitments, though publicly available estimates suggest these represent only a small fraction of his total net worth. (Benzinga)

Q8: Is his net worth likely to keep increasing?

A: It depends on NVIDIA’s future performance (especially in AI/data-centre markets), his ownership share (dilution risk), regulatory or competitive risks, and his personal decisions around share sales. All of these will affect whether his wealth continues to grow.

Conclusion

Jensen Huang’s net worth is a compelling case study in how visionary leadership, technical expertise and timing in a high-growth industry (AI and semiconductors) can translate into enormous personal wealth. His story underscores the power of equity ownership in a high-growth enterprise. At the same time, it shows the risks inherent in concentration of wealth in one company. For observers in India and globally who follow wealth creation, tech entrepreneurship or investing, Huang’s trajectory offers valuable insights.

Let me know if you’d like a deeper dive — for example into his philanthropic efforts, the breakdown of his share sales, comparisons with other tech billionaires, or a historical timeline of his wealth growth.

Leave A Comment

0 Comment