The stock market has always been a fascinating world where investors look for ways to predict future price movements and profit from them. Among the many financial instruments available, stock market futures stand out as a popular choice for traders who want to speculate on market direction or hedge their portfolios.

In this comprehensive guide, we will explore what stock market futures are, how they work, why they matter, and how investors can trade them effectively. Whether you are a beginner or a seasoned investor, understanding futures can help you make better financial decisions.

What Are Stock Market Futures?

Stock market futures are financial contracts that obligate the buyer to purchase, and the seller to sell, a specific stock index or individual stock at a predetermined price on a future date. These contracts are standardized and traded on futures exchanges.

Unlike buying stocks, where you own the shares outright, trading futures means you are entering into an agreement based on the future price movement of the underlying asset. This asset can be a stock index like the S&P 500, Nifty 50, or Dow Jones Industrial Average, or even an individual company stock.

For example, if you buy a futures contract on the Nifty 50 index for delivery in December at 22,000, you are betting that the index will be higher by that time. If it does rise, you make a profit; if it falls, you incur a loss.

How Do Stock Market Futures Work?

Futures contracts are standardized agreements traded on regulated exchanges such as the Chicago Mercantile Exchange (CME), Intercontinental Exchange (ICE), or in India, the National Stock Exchange (NSE). Each futures contract has details like:

- The underlying asset: The index or stock being traded.

- The contract size: The amount of the underlying asset the contract represents.

- The expiration date: The date when the contract ends.

- The price: The agreed-upon price for the asset on the expiration date.

When you enter into a futures contract, you don’t pay the full price upfront. Instead, you pay a margin — a percentage of the total contract value. This margin acts as a security deposit.

Example

Suppose you buy a futures contract for Reliance Industries at ₹2,500 per share, and each contract represents 250 shares. The total value of the contract is ₹6,25,000. You might only need to deposit 10% of this value as a margin — ₹62,500.

If the stock price rises to ₹2,550, you gain ₹50 per share, or ₹12,500 in total. Conversely, if it falls to ₹2,450, you lose ₹12,500.

Why Are Stock Market Futures Important?

Futures play a crucial role in modern financial markets. They serve multiple purposes, including price discovery, risk management, and speculation.

1. Price Discovery

Futures markets help investors and traders gauge expectations about where prices are heading. Because they are traded almost around the clock, they often react faster to global events than stock markets.

2. Hedging Risk

Investors and companies use futures to protect against adverse price movements. For instance, if a fund manager holds a large stock portfolio but fears a market decline, they can sell index futures to offset potential losses.

3. Speculation

Speculators use futures to profit from price changes without owning the underlying asset. They take positions based on their expectations of market direction. Since futures allow for high leverage, they can generate large profits — or losses — from small price movements.

4. Liquidity and Transparency

Because stock futures are traded on regulated exchanges, they offer liquidity, price transparency, and minimal counterparty risk. The clearinghouse guarantees every trade, ensuring that both sides fulfill their obligations.

Types of Stock Market Futures

Stock market futures can be categorized into two main types:

1. Index Futures

These are based on a stock market index such as the S&P 500, Nifty 50, or Dow Jones. They allow investors to speculate or hedge on the performance of an entire market segment rather than individual stocks.

Example: Nifty 50 futures in India or S&P 500 futures in the US.

2. Single Stock Futures

These are contracts based on individual company stocks like Apple, Reliance Industries, or Tesla. Investors use these to speculate on the price movement of a specific company.

How to Trade Stock Market Futures

Trading futures requires a clear understanding of how contracts work, along with discipline and risk management. Here’s a step-by-step guide:

Step 1: Open a Trading Account

To trade futures, you need to open a demat and trading account with a broker who offers access to futures exchanges. Ensure that your broker supports margin trading and provides a robust trading platform.

Step 2: Understand Margin Requirements

Before placing any trade, you must deposit an initial margin. This acts as collateral and varies depending on market volatility and exchange rules. If your account falls below the maintenance margin, you’ll need to add more funds.

Step 3: Choose Your Futures Contract

Select the stock or index futures you want to trade. Look at factors such as liquidity, contract size, and expiration date.

Step 4: Take a Position

You can take two types of positions:

- Long Position: If you expect prices to rise, you buy futures.

- Short Position: If you expect prices to fall, you sell futures.

Step 5: Monitor and Exit the Trade

Futures can be squared off before expiration. Traders often close their positions before the expiry date to realize profits or limit losses.

Advantages of Stock Market Futures

Trading in futures offers several benefits to investors and traders alike.

1. Leverage

Futures allow you to control large positions with a relatively small capital outlay. This amplifies potential profits but also increases risks.

2. Hedging Opportunities

Investors can use futures to hedge against price fluctuations in their stock portfolios, reducing market exposure.

3. High Liquidity

Stock and index futures are highly liquid instruments, allowing traders to enter and exit positions quickly without significant price impact.

4. Transparency

Because futures are exchange-traded, prices are transparent, and there’s minimal counterparty risk due to the clearinghouse mechanism.

5. Diversification

Index futures allow investors to gain exposure to an entire market index without buying all the underlying stocks.

Risks Involved in Stock Market Futures

While futures can be profitable, they also carry substantial risk. Understanding these risks is crucial before investing.

1. Leverage Risk

Leverage can amplify both gains and losses. A small market movement against your position can lead to significant losses.

2. Volatility

Futures markets are often more volatile than the underlying stocks. Rapid price changes can lead to margin calls or forced liquidation.

3. Market Timing

Predicting short-term market movements is challenging. Even experienced traders can misjudge trends, resulting in losses.

4. Expiration and Rollover

Futures have a fixed expiration date. Traders must either settle or roll over contracts, which can involve additional costs.

5. Complexity

Futures trading involves advanced concepts like margin calls, mark-to-market, and hedging, making it less suitable for beginners without proper training.

Factors Affecting Stock Market Futures Prices

Several factors influence the price of stock market futures:

1. Spot Price of the Underlying Asset

The most important factor is the current price of the stock or index.

2. Time to Expiry

The difference between the spot price and the futures price narrows as the contract approaches expiration.

3. Interest Rates

Higher interest rates can increase futures prices since holding the underlying stock becomes more expensive.

4. Dividends

Expected dividends reduce futures prices because the buyer of a future does not receive dividend payments.

5. Market Sentiment

Futures often reflect investor expectations about future market conditions, which can be influenced by economic data, geopolitical events, or company earnings.

Strategies for Trading Stock Market Futures

Futures trading can be approached using different strategies depending on market outlook.

1. Hedging Strategy

Investors hedge existing stock portfolios by taking opposite positions in futures. For example, if you hold large equity positions, selling index futures can offset potential losses during a downturn.

2. Arbitrage Strategy

Traders exploit price discrepancies between the cash market and the futures market to earn risk-free profits.

3. Spread Trading

This involves buying one futures contract and selling another of the same or different expiry dates to profit from price differences.

4. Directional Trading

Speculators trade futures based on market forecasts, taking long or short positions depending on whether they expect the market to rise or fall.

Example of Stock Market Futures Trading

Let’s consider an example with Nifty 50 futures:

- Current Nifty 50 Index: 22,000

- December Nifty Futures: 22,100

- Lot Size: 50 units

- Margin Required: 10%

If you expect the index to rise, you buy one futures contract at 22,100. If the index goes up to 22,500 before expiration:

Profit = (22,500 – 22,100) × 50 = ₹20,000

If the index falls to 21,800:

Loss = (22,100 – 21,800) × 50 = ₹15,000

This example shows how small index movements can result in substantial profits or losses due to leverage.

Global Futures Markets

Stock market futures are traded worldwide, with some of the most prominent exchanges including:

- Chicago Mercantile Exchange (CME) – USA

- Intercontinental Exchange (ICE) – USA/UK

- Euronext – Europe

- National Stock Exchange (NSE) – India

- Hong Kong Futures Exchange (HKFE) – Hong Kon

- Singapore Exchange (SGX) – Singapore

These exchanges ensure that futures markets remain liquid, transparent, and globally accessible.

Stock Market Futures in India

In India, NSE and BSE are the main platforms for trading stock market futures. The most popular contracts include Nifty 50, Bank Nifty, and individual large-cap stocks like Reliance, HDFC Bank, and Infosys.

Futures in India are cash-settled, and traders must maintain margins as per SEBI regulations. Futures trading has become increasingly popular among retail investors, offering opportunities for speculation, arbitrage, and hedging.

Tips for Trading Stock Market Futures Successfully

- Start with Index Futures

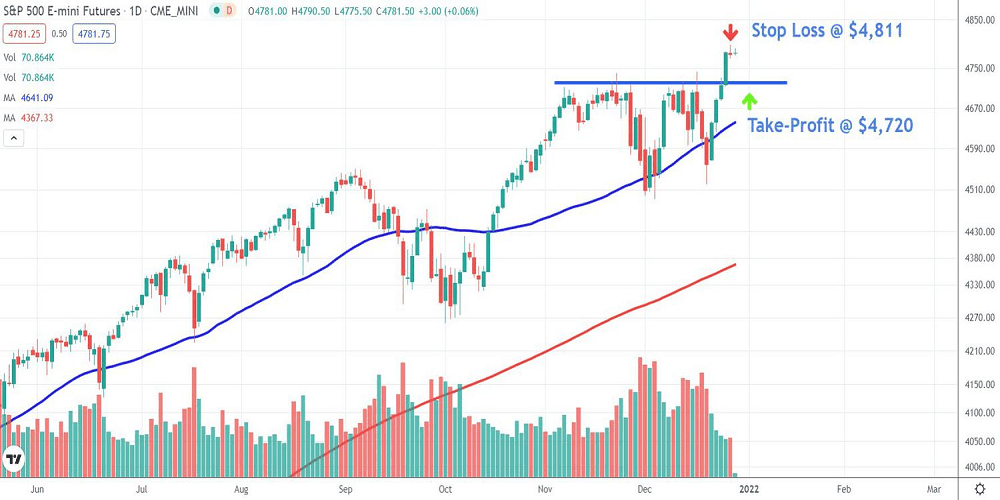

Index futures are less volatile than individual stock futures and are ideal for beginners. - Use Stop-Loss Orders

Protect your capital by setting stop-loss levels to limit potential losses. - Understand Margin Requirements

Always maintain sufficient funds to meet margin calls and avoid forced liquidation. - Follow Market Trends

Study technical and fundamental indicators to identify entry and exit points. - Avoid Over-Leveraging

While leverage increases profit potential, it can also magnify losses. Trade within your risk capacity. - Stay Updated

Economic data, interest rate changes, and corporate announcements can significantly affect futures prices. - Practice with Virtual Trading

Use demo accounts to practice strategies before committing real money.

Future of Stock Market Futures

The role of futures in the global financial system continues to grow. With the rise of algorithmic trading, artificial intelligence, and global interconnectedness, futures markets have become more sophisticated and efficient.

Emerging trends such as micro futures contracts, crypto futures, and cross-border derivatives are making futures trading more accessible to small investors.

As financial literacy improves and technology advances, stock market futures will likely remain a core part of investment strategies worldwide.

Conclusion

Stock market futures are powerful financial instruments that allow investors to speculate, hedge, and manage risk efficiently. They provide exposure to broad market movements without the need to buy underlying assets directly. However, their leverage and complexity make them suitable only for those who understand the associated risks.

To succeed in futures trading, one must have a clear strategy, disciplined risk management, and a thorough understanding of how these instruments work. Whether used for hedging or speculation, futures can be an essential tool in any trader’s arsenal when handled with caution and knowledge.

FAQs About Stock Market Futures

1. What is the main purpose of stock market futures?

The main purpose of stock market futures is to allow investors to hedge against future price changes or to speculate on the direction of the market. They help in managing risk and discovering prices for future dates.

2. Are futures safer than stocks?

Futures are not safer than stocks. In fact, they carry higher risk due to leverage and market volatility. While they offer higher profit potential, they can also lead to significant losses.

3. Can beginners trade in futures?

Beginners can trade in futures, but it is advisable to start with small positions, gain experience, and understand margin requirements before committing large capital.

4. What is the difference between futures and options?

In a futures contract, both parties are obligated to buy or sell the asset at a future date. In an options contract, the buyer has the right but not the obligation to execute the trade.

5. How much margin is required to trade stock futures?

The margin requirement varies depending on the volatility of the stock and exchange regulations. Typically, it ranges from 5% to 15% of the total contract value.

6. What happens if I do not close my futures position before expiry?

If you hold a futures contract until expiry, it will be settled automatically. Depending on the market, settlement can be done either in cash or by delivery of the underlying asset.

7. Can I trade futures on international indices from India?

Yes, some brokers allow trading in international futures like S&P 500 or Dow Jones through global trading accounts. However, regulatory guidelines must be followed.

8. Is futures trading profitable?

Futures trading can be profitable for disciplined and knowledgeable traders who manage risk effectively. However, due to leverage, it can also result in heavy losses if not handled carefully.

9. What is the expiry date in futures contracts?

The expiry date is the final trading day of the futures contract. After this date, the contract is settled, and positions are squared off automatically.

10. Are futures suitable for long-term investors?

Futures are primarily short-term instruments due to their expiration dates. Long-term investors typically prefer buying and holding stocks rather than trading futures.

Leave A Comment

0 Comment