When it comes to telecommunications and mobile technology, Nokia has been a name that has stood the test of time. From being a leader in the mobile phone market during the 1990s and early 2000s to transforming into a major player in network infrastructure and 5G technology, Nokia Corporation has undergone several phases of evolution. Today, investors are paying close attention to Nokia stock, curious about its performance, growth potential, and place in the ever-changing technology sector.

In this detailed guide, we’ll explore everything about Nokia stock — its history, financial performance, future outlook, risks, and whether it is a good investment choice.

The Evolution of Nokia

Nokia Corporation, founded in 1865 in Finland, started as a paper mill company before venturing into the electronics and telecommunications industry. It gained global recognition in the 1990s and early 2000s for producing some of the most reliable and iconic mobile phones. However, with the emergence of smartphones and the dominance of companies like Apple and Samsung, Nokia’s mobile business declined significantly.

In 2014, Nokia sold its mobile phone business to Microsoft. Since then, the company has shifted its focus to network infrastructure, 5G technology, and digital communication solutions, which now form the backbone of its business. This transition has positioned Nokia as a key player in the telecommunications equipment market, competing with companies like Ericsson and Huawei.

Nokia Stock Overview

Nokia Corporation trades on several major stock exchanges under different tickers:

- NYSE (New York Stock Exchange): NOK

- Helsinki Stock Exchange: NOKIA

- Frankfurt Stock Exchange: NOA3

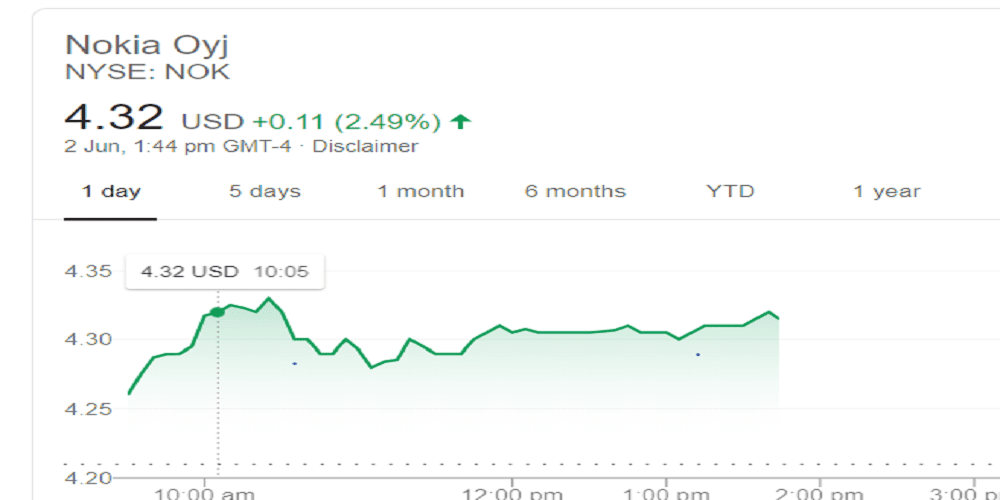

As of 2025, Nokia’s market capitalization fluctuates based on global telecom trends, supply chain developments, and 5G rollout progress. The company’s financial health and strategic partnerships play a significant role in determining the performance of Nokia stock.

Historical Performance of Nokia Stock

The journey of Nokia stock has been a story of highs and lows.

During the early 2000s, Nokia’s stock was among the top performers in Europe. However, the decline in its mobile phone business caused a sharp drop in share prices. When Microsoft acquired Nokia’s phone unit in 2014, many investors assumed it was the end of Nokia as a major tech brand.

But Nokia’s reinvention as a telecom equipment provider gradually restored investor confidence. The company has since focused on expanding its 5G network solutions and software offerings, which have started to generate stable revenues.

In recent years, Nokia’s stock performance has shown moderate improvement due to increased global demand for network infrastructure, government investments in 5G, and growing digitalization trends.

Nokia’s Business Model and Revenue Streams

Nokia’s revenue primarily comes from three segments:

- Network Infrastructure – This segment includes mobile and fixed networks, IP routing, optical networking, and network services. It accounts for a major portion of Nokia’s total revenue.

- Cloud and Network Services – Focused on digital transformation, software, and cloud-based solutions.

- Nokia Technologies – This unit manages licensing of Nokia’s patents and intellectual property to other companies, generating high-margin income.

By diversifying into these areas, Nokia has created a more sustainable and technology-driven business model, reducing its dependence on the volatile mobile handset market.

Nokia and the 5G Revolution

One of the major factors influencing Nokia stock today is its involvement in the global 5G rollout. Nokia is one of the few companies in the world with a comprehensive 5G infrastructure portfolio.

The company provides equipment and services that help telecom operators deploy faster and more efficient 5G networks. Nokia’s clients include major telecom giants like AT&T, Verizon, Deutsche Telekom, and others.

Nokia’s strong position in 5G gives it a competitive edge, especially as more countries invest heavily in next-generation networks. This growth potential makes Nokia an attractive consideration for long-term investors who believe in the future of connectivity.

Financial Performance and Earnings

Nokia’s financial results over the past few years have shown signs of stability and gradual growth. The company has managed to maintain steady revenue, driven by 5G contracts and enterprise solutions.

Operating margins have improved as Nokia continues to cut costs, optimize operations, and focus on higher-value projects. The company’s cash flow remains strong, providing flexibility for further research and development (R&D) and shareholder returns.

However, profit margins are still under pressure due to competitive pricing in the telecom equipment market and supply chain costs. Investors need to monitor Nokia’s quarterly earnings reports closely to understand its progress in profitability and growth.

Dividend Policy

Nokia has a history of paying dividends, although it has been inconsistent at times due to financial challenges. In recent years, as profitability improved, the company reinstated dividends and even initiated share buybacks.

For income-focused investors, Nokia stock’s dividend yield may not be the highest, but it signals financial stability and management’s confidence in future earnings.

Nokia’s Competitors

Nokia operates in a highly competitive industry. Its primary competitors include:

- Ericsson (Sweden) – Another major 5G and telecom equipment provider.

- Huawei (China) – A dominant global player, though facing restrictions in certain countries.

- Samsung Networks (South Korea) – Expanding its presence in 5G infrastructure.

Competition in this sector is intense, and pricing pressures often impact profitability. However, Nokia’s global reputation, patents, and partnerships help it maintain a strong position.

Analyst Opinions and Market Sentiment

Analysts generally view Nokia stock as a moderate growth opportunity. It is not typically considered a high-growth stock like major tech companies, but rather a steady performer with potential upside in the 5G and digital infrastructure markets.

Market sentiment around Nokia stock tends to shift based on key developments such as new contracts, quarterly earnings, or global telecom policy changes. Investors who focus on long-term stability and moderate growth may find Nokia an appealing option.

Risks Associated with Nokia Stock

Like any investment, Nokia stock carries certain risks. Some of the main challenges include:

- Intense Competition – Rivals like Huawei and Ericsson could gain market share.

- Geopolitical Factors – Restrictions, tariffs, and global supply chain issues may affect operations.

- Currency Fluctuations – As a Finnish company with global operations, exchange rate movements impact profitability.

- Technological Shifts – Failure to keep up with rapid innovations could reduce Nokia’s competitiveness.

- Market Volatility – Telecom infrastructure demand depends on government and enterprise spending cycles.

Investors should consider these risks before making decisions about buying or holding Nokia stock.

Future Outlook and Growth Potential

The future of Nokia largely depends on how well it capitalizes on 5G, cloud services, and enterprise networking opportunities.

Nokia’s strategy involves strengthening its technology base, forming strategic partnerships, and expanding into new markets like private networks and digital infrastructure services for industries.

As the world moves towards advanced connectivity — including 6G research and the Internet of Things (IoT) — Nokia is well-positioned to benefit from these transformations.

If the company continues to improve profitability, maintain strong cash flow, and innovate in network solutions, Nokia stock could deliver steady returns in the coming years.

Should You Invest in Nokia Stock?

Investing in Nokia stock depends on your financial goals and risk tolerance.

If you’re looking for a long-term investment in a stable technology company with exposure to the 5G and telecom infrastructure market, Nokia could be a sound choice. It may not deliver rapid short-term growth, but it offers consistent value driven by global connectivity demand.

However, for investors seeking high-growth tech stocks or those with low risk tolerance, Nokia might seem less attractive due to its slower revenue expansion and competitive challenges.

Key Takeaways

- Nokia has successfully transformed from a mobile phone manufacturer to a global leader in telecom infrastructure and 5G technology.

- Its diversified business model and focus on innovation provide long-term stability.

- The company faces competition from Ericsson, Huawei, and Samsung but remains a strong player in the industry.

- Nokia stock offers moderate growth potential and steady dividend returns.

- The company’s performance is closely tied to global 5G expansion and network investments.

FAQs on Nokia Stock

1. What is the stock symbol for Nokia?

Nokia trades under the ticker symbol NOK on the New York Stock Exchange (NYSE) and NOKIA on the Helsinki Stock Exchange.

2. Is Nokia a good stock to buy?

Nokia is considered a stable investment for long-term investors interested in 5G and telecom infrastructure. It may not provide rapid growth, but it offers steady performance and potential dividend returns.

3. Does Nokia pay dividends?

Yes, Nokia has resumed paying dividends in recent years after improving its financial position. The dividend yield varies depending on the company’s performance and market conditions.

4. What factors affect Nokia’s stock price?

Nokia’s stock price is influenced by 5G adoption rates, competition, quarterly earnings, global economic trends, and currency fluctuations.

5. How can I buy Nokia stock?

You can buy Nokia stock through a brokerage account on major exchanges like NYSE or Helsinki Stock Exchange. It is also available on online trading platforms that support international stocks.

6. Who are Nokia’s major competitors?

Nokia’s main competitors are Ericsson, Huawei, and Samsung Networks, all of which operate in the global telecommunications and 5G equipment markets.

7. What is Nokia’s main source of revenue now?

Nokia earns most of its revenue from network infrastructure and 5G services, including hardware, software, and licensing of intellectual property.

8. What is the long-term outlook for Nokia stock?

Nokia’s long-term outlook appears positive, supported by global 5G expansion, digital transformation trends, and growth in enterprise networking solutions.

9. Why did Nokia’s stock fall in the past?

Nokia’s stock declined primarily due to its failure to adapt to the smartphone revolution in the late 2000s. The sale of its mobile business to Microsoft marked a major turning point, leading to a restructured business model.

10. Is Nokia working on future technologies like 6G?

Yes, Nokia is actively involved in early research and development of 6G technologies, aiming to be a pioneer in next-generation communication systems.

Conclusion

Nokia’s story is one of transformation and resilience. Despite losing its dominance in the mobile phone market, the company reinvented itself as a leader in global telecommunications and 5G infrastructure.

For investors, Nokia stock represents a balance between stability and moderate growth. Its continued focus on innovation, cost efficiency, and network expansion makes it a potential long-term holding in the tech and telecom sector.

As the world moves deeper into the 5G and eventually 6G era, Nokia’s ability to stay competitive and adapt to new technologies will determine the true value of its stock in the coming years.

Leave A Comment

0 Comment